Partnerships

FIGIEFA is at the core of numerous alliances and forums working on the aftermarket issues. It allows us to play a leading role in the defence of the wider independent automotive aftermarket.

Publications

FIGIEFA publishes regularly different documents to explain and precise its position on various issues.

Events

FIGIEFA organises various events with market operators, stakeholders and policy makers, to discuss and explain the needs and position of the wider aftermarket.

Vehicle Maintenance, Service and Repair During the Warranty Period

Practical guide for independent aftermarket operators and consumers

FIGIEFA Manifesto 2024-2029

You will find here our 5 working pillars for the currently starting European political mandate: https://acrobat.adobe.com/id/urn:aaid:sc:EU:06132649-1a98-451d-bfc4-691fdcea25f0

Competitiveness in the Automotive Aftermarket in the Context of the Technology Shift

This is a recent study developped by Berylls in collaboration with CLEPA and FIGIEFA. The automotive sector is one of the most relevant contributors to the wealth of European citizens. In the past, a highly competitive aftermarket granted affordable and individual mobility to a large part of the population, but this might change with the ongoing shift of technology. CLEPA, FIGIEFA, Automechanika, and Berylls conducted a study to analyze the most important influencing factors that have the potential to change the aftermarket landscape and possibly drive a shift in the existing market balance between the channels of the independent aftermarket (IAM) and the original equipment services (OES). To substantiate and draw conclusions, we identified five key influencing factors likely to drive the most significant changes and defined seven key markets in Europe to provide a thorough overview and subsequently build a market model to forecast the expected market development. We conducted interviews with highly esteemed experts across the entire aftermarket value chain to gather qualitative feedback, sustain our observations, and illustrate changes in the balance of power, price, and access to data, forming highly probable market scenarios. Download the full study now: https://www.berylls.com/wp-content/uploads/2024/09/Berylls-Aftermarket_Insight_2024_vf.pdf

European Independent Automotive Aftermarket Panorama

This is a recent study developped by Roland Berger in collaboration with FIGIEFA. The automotive industry sector is one of Europe's key economic sectors and the third-largest spending category by consumers, after housing and food. Within the industry sector, the aftermarket plays a crucial role in supporting the use, maintenance and repair of vehicles. It represents a market of around EUR 118 billion in parts alone within the European Union, of which the multi-brand independent aftermarket (IAM) makes up EUR 73 billion or around 62%. The IAM is particularly important when it comes to parts, servicing and repairs for vehicles that are more than four years old – around 195 million vehicles, or 70% of those currently on European roads. Why, then, is the multi-brand independent aftermarket sometimes viewed as something of an afterthought within the industry? It represents a key profit pool for Europe's automotive sector, enables road-based mobility, maintains essential service vehicles, keeps mobility affordable and improves the sustainability of road-based transportation. Indeed, its role is fundamental throughout the vehicle lifetime – and we believe that it deserves greater recognition as a key element of the value chain within the industry. For the purpose of this report, we surveyed more than 380 members of FIGIEFA, the European Federation of Independent Automotive Aftermarket Distributors, located across Europe. Based on the results of this survey and additional interviews with the chief executive officers of more than two dozen major independent parts distribution groups, corporates and FIGIEFA national member associations, combined with the expertise of Roland Berger's specialists, we identify a number of key trends in the market. In this report, we present the results of our investigation and our insights into how the role of the IAM may change in the future, arguing the case for why the IAM needs to be rebranded in a way that recognizes its vital place in the automotive industry – as an active contributor to Europe's competitiveness and the European economy as a whole. Download the full study now: https://content.rolandberger.com/hubfs/07_presse/European%20Independent%20Automotive%20Aftermarket%20Panorama_final.pdf

New Competition Law Framework

Brochure – The new competition law framework for the automotive aftermarket – Right to Repair Campaign, 2010

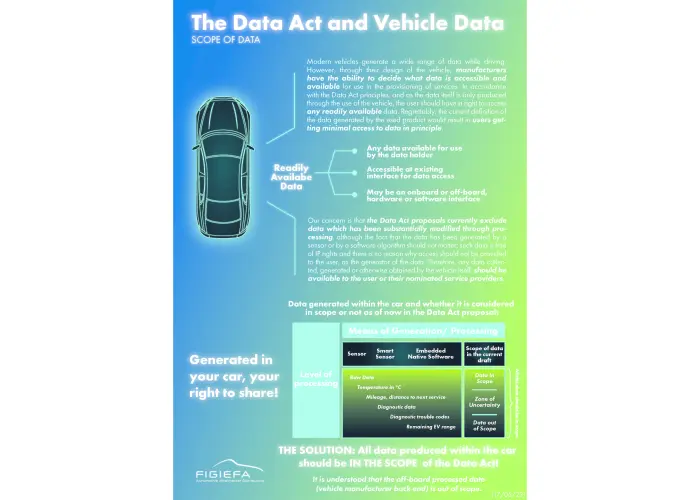

Free Flow of Data

Brochure 2016 – Free Flow of Data – Commission Communication – Input from the Independent Automotive Aftermarket

Updated Ricardo Survey of 09-2017 on Access to RMI for parts identification

Parts Identification Survey – Final Report

OEM 3rd Party Telematics – General Analysis

To assess the technological feasibility of guaranteeing fair and undistorted competition in the automotive digital aftermarket, several European associations representing independent operators and consumers have commissioned a study to Knobloch & Gröhn, a technology consultancy.

Policy Event – Connected mobility services at the crossroads – Now, which route to take?

Europe is on its way to connected and automated driving, and vehicles become the new mobility and services hub. This puts the EU at a crossroads: Will the future market for connected and automated mobility in general still be able to support innovation, competition and consumer choice?

Manifesto for fair digitalisation opportunities

Broad industry coalition calls upon EU decision makers to ACT NOW to ensure a genuine digital level-playing field for remote access to in-vehicle data.Competition, innovation and consumer interests must be at the heart of the EU Digital Single Market.

Manifesto for Fair Digitalisation Opportunities

Broad coalition calls upon EU decision makers to put forward legislation by 2020 ensuring a genuine digital level-playing field for remote access to in-vehicle data and functions.

FIGIEFA provides its feedback on the roadmap for the evaluation of the Motor Vehicle Block Exemption Regulation

FIGIEFA is pleased to comment on the evaluation roadmap and confirms the important role of the sec-tor specific rules for maintenance & repair services and the distribution of spare parts. The MVBER and the Guidelines provided in practice protection against a number of distortions. Both currently serve as an important framework which allows e.g. OE parts producers to supply independent parts distributors and the independent and authorised aftermarket. Also, parts suppliers’ right to brand their OE products with their own logo (dual branding) and the definition of ‘original and matching quality parts’ has an important effect in the market helping to demonstrate the true origin and quality of parts to consumers and their competitive choices. Hence, hard-core restrictions serve an important purpose.

Survey – Impact of COVID-19 on independent spare parts distributors

The COVID-19 had a fast and disruptive impact on the European Union, its people and its companies. The unprecedented human impact is closely followed by an important economic and social shockwave, which magnitude can be compared with the 2007 financial crisis, if not more. Necessary lockdown measures had a huge and immediate impact on the consumption of households, which could be reinforced in the near future with the job losses. SMEs, with limited liquidities, are particularly at risk.

FIGIEFA contribution to the EDPB consultation on draft guidelines for data privacy in the context of connected vehicles

We welcome the EDPB Guidelines which bring important clarifications on the processing of personal data in the context of connected vehicles and mobility related applications.

Euro VI Heavy Duty Vehicles type-approval legislation

Brochure – Access to vehicle repair & maintenance information for heavy duty vehicles – AFCAR Alliance, 2011

Cyber-Security Concept for a secure Onboard Telematics Platform

Connected vehicles offer the the possibility to exchange data with different actors, in particular automotive suppliers, e.g. for remote and predictive maintenance and repair. In order to allow communication with multiple partners, an Open Telematics Platform (OTP) needs to be implemented on vehicles, enabling multiple parties to access the vehicle data. The remote access to vehicle needed to enable such services yield various attack surfaces. For instance, an unauthenticated party may access private vehicle data (e.g. the driver’s route history). In order to address these attacks surfaces, the UNECE WP29 and the ISO/SAE 21434 require OEMs, suppliers and parties accessing the vehicle to establish security risk management supporting the vehicles security lifecycle on technical and organizational level. On a technical level, a set of cybersecurity measures must be implemented to restrict the vehicle access to authenticated parties and to manage this access for the whole lifecycle of the vehicle. On an organizational level, processes to assess risks and treat them according to their severity are required.

FIGIEFA is working for you…

A vast majority of the legislation for the automotive aftermarket is decided at European Union’s or at United Nations’ levels. They have a direct impact on your business. A single wrong, inaccurate or misplaced word could put the entire sector out of business. A strong political representation is needed to avoid that risk.

Creating a level playing field for vehicle data access: Time for an ambitious legislation!

Brussels, 13 September 2021 – Ahead of the European Commission’s Workshop on “Access to In-Vehicle Data” on 17 September 2021, a broad coalition representing automotive aftermarket operators, vehicle dealers, mobility services and consumers urges the European Commission to publish an ambitious legislative proposal on access to in-vehicle data by the first quarter of 2022 at the latest.

New EU Data Framework can drive a wave of innovation in the European automotive and mobility services eco-system

European Independent Service Providers welcome a very positive dialogue with Commissioner Thierry Breton

FIGIEFA’s Position on the European Commission’s Initiative to Decarbonise Corporate Fleets

Last week, EU Commissioner for Sustainable Transport and Tourism Apostolos Tzitzikostas hosted a High-Level Strategic Dialogue with stakeholders to discuss the Greening Corporate Fleets initiative.

Statement on Russian invasion & war in Ukraine

Brussels, 9 May 2022 - FIGIEFA has been closely following the recent developments triggered by the invasion that Russia initiated against Ukraine and that millions of innocent citizens are now victim of. Already after a couple of weeks, this war has developed into a humanitarian catastrophe. The Russian aggression is also directly harming businesses represented by FIGIEFA’s Members, their employees, and their families. FIGIEFA Members are giving financial support to refugees, but also particularly assist families from Ukrainian parts distribution outlets.

Talents4AA: creation of a professional association aiming to attract and retain talents

Paris, March 23rd, 2022 – After 2 years of preliminary work and exchanges, the Talents4AA association was officially created in Paris (France) in March 2022 with the aim of attracting and retaining talents of all ages and origins, in all professions, in one of the most attractive sectors: the Automotive Aftermarket.

European Commission’s proposal for Data Act welcomed, but robust automotive-specific legislation urgently required

Brussels, 23 February 2022 – A broad coalition representing a wide range of major automotive aftermarket stakeholders, as well as operators in the mobility services value chain, consumers, the insurance and the tyre industries welcomes today’s publication of the proposal by the European Commission for a European Union’s Data Act.

EU Presidency Outlook: Denmark

Join us for a timely discussion on Denmark’s priorities for its upcoming presidency of the Council of the EU, starting this July. Leading EU policymakers, including the Danish Coreper II Ambassador and two Danish Members of the European Parliament will explore – together with The Parliament’s editorial team and FIGIEFA – Denmark’s strategic vision for Europe in turbulent geopolitical times. Part of a recurring series marking each rotating presidency, this briefing debate and networking offers unique insights into the agenda and expected impact of the incoming mandate on EU policies.

The Automotive Aftermarket: A Cornerstone for Europe’s Industrial and Mobility Future

The Automotive industry as a whole is living through systemic changes and challenges at an unprecedented pace. Technological developments in vehicle components, together with the exponential rate of its connectivity, are making manufacturing, driving, and repair and maintenance a different reality. At the same time, e-mobility solutions and the deployment of Electric Vehicles, as well as the arrival of an entirely new kind of engines and parts deeply impact the entire automotive ecosystem. One crucial part of the industry is navigating these changes with steady force and leading in innovation and circularity practices: the Independent Aftermarket (IAM). In the current geopolitical incertitude, rising trade wars and protectionism, the European Commission has established as one of its main priorities for the starting mandate the reinforcement of the automotive industry and European companies' competitiveness and will announce its new Automotive Industrial Action Plan on the 5th of March. In this context, the IAM in general and parts distribution and wholesaling in particular, represented by FIGIEFA, call on a holistic approach of the entire automotive ecosystem for this Action Plan and future European legislation. The Roland Berger Aftermarket Panorama study that will be presented at this event will show the extent to which the IAM is capital in driving the sector and the whole industrial competitiveness for Europe, together with an unmatched economic and societal impact. In the aftermath of the publication of the European Commission Automotive Industrial Action Plan, which is expected on the 5th of March, we will assess what is ahead of us by bringing the voice of the IAM industry, consumers, and policymakers together. We will offer a vision of the positive and constructive contribution our sector can make to achieving a thriving industrial future for Europe. Register here: https://events.euractiv.com/event/info/media-partnership-the-automotive-aftermarket-a-cornerstone-for-europes-industrial-and-mobility-future

FIGIEFA CONFERENCE 2024

Our FIGIEFA 2024 Conference, taking place on the 23rd and 24th of October in Brussels at the Renaissance Hotel in Brussels, will provide an analysis of the political situation in Brussels with the new European Parliament and the new Commission. Also, keynote presentations will address current trends in the European automotive aftermarket landscape, provide an update on market facts & figures and examine the role of artificial intelligence in this sector. This will set the stage for discussions on what is needed to remain competitive in the market for services supporting affordable mobility for consumers and business operators alike. We will welcome attendees to a cocktail & dinner on the evening of the 23rd of October. This will be an opportunity to network with FIGIEFA’s independent parts/ distributor, wholesaler & trade group community, industry peers, and sector association colleagues. Please contact figiefa@figiefa.eu if interested to attend.

FIGIEFA CONFERENCE 2026

Our FIGIEFA 2026 Conference will take place on the 4th of November in Brussels at the Double Tree by Hilton Hotel. We will welcome attendees to a cocktail & dinner on the evening of the 3rd of November. This will be an opportunity to network with FIGIEFA’s independent parts distributor, wholesaler & trade group community, industry peers, and sector association colleagues. Please contact figiefa@figiefa.eu if interested to attend.